Are you thinking about opening a gold IRA, but you aren’t sure which company you want to work with? There are many options in the gold IRA industry, so finding the best investment partner isn’t always easy. When I first started investing in gold IRAs, I was very overwhelmed by the process, and I also didn’t know which company would be best for me and my financial goals.

Now, I have worked with all types of precious metals investment companies, including Money Metals Exchange.

If you are interested in investing in physical metal, and you are looking to the future, you may want to consider Money Metals Exchange. I trust this company, and I want you to find out if it’s right for you.

Disclaimer:

While I do feel MoneyMetals is reputable, I invested elsewhere. Click here to see my top gold IRA companies.

With silver and gold, plus other precious metals and precious metals IRAs, Money Metals Exchange could be a great option to secure your wealth. Keep reading to learn more about what this company offers, and to learn more about how it works.

Table of Contents

ToggleMoney Metals Exchange – What is This Precious Metals Dealer All About?

Founded in 2010, Money Metals Exchange, LLC, is a precious metals dealer that offers gold IRAs and other products in the US. The company is well known for its many options, including uncommon offerings like copper and rhodium, and it offers good pricing and honest communication.

Another interesting thing about Money Metals Exchange is that the founder and CEO, Stephan Gleason, is very active in the company. He founded the business when he was working for a national newsletter publishing company, and is now focused on sharing his knowledge and experience with others.

Gleason is also focused on sharing information about precious metals investments with others, and is known to be experienced in helping both large and small scale investors. Today, he is a well known executive, strategist, and investor who appears on Fox News, CNN, CNBC, and Fox Business. He has also been published in hundreds of newspapers and other publications including Newsweek and the Wall Street Journal.

What Makes Money Metals Exchange Different from Other Companies?

I’ve invested in many precious metals investment companies over the years, and Money Metals Exchange is one that stands out thanks to its amazing products. These include the following:

Available Precious Metals

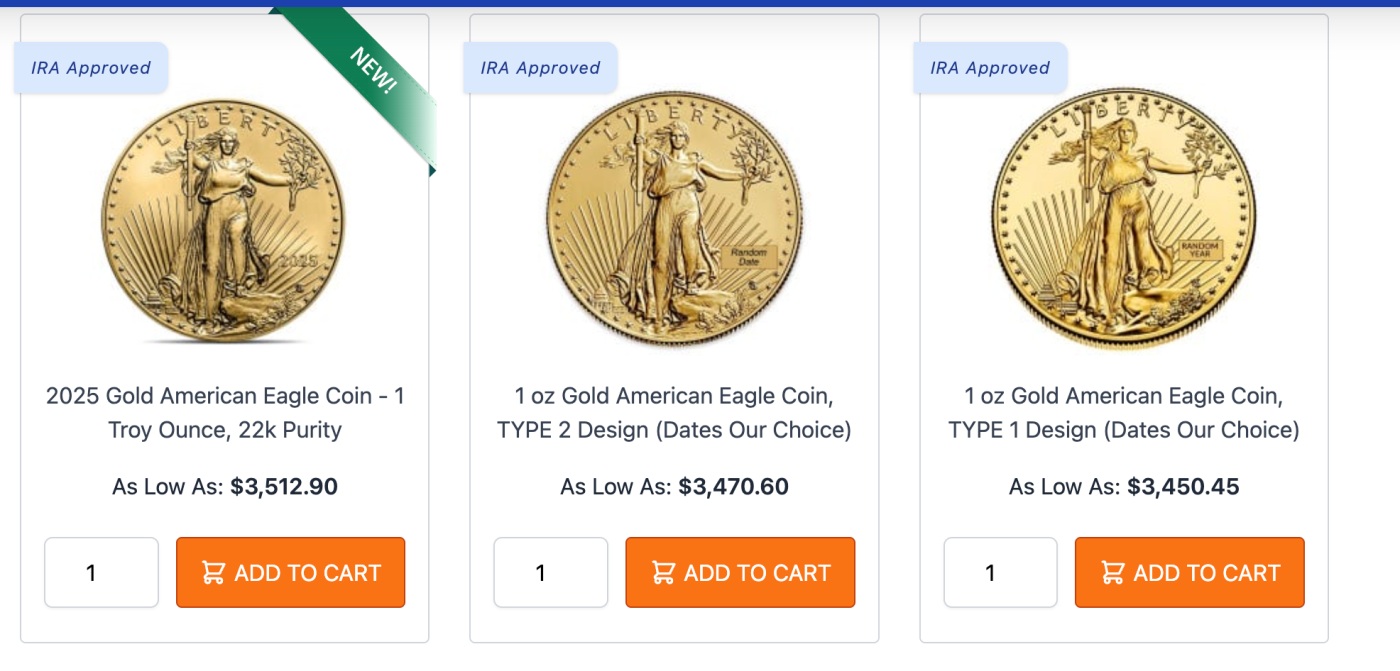

Before investing in the Money Metals Exchange, I started looking at customer reviews on sites like the BBB. When going through most of the reviews there, I noticed that people were very impressed with the number of metals and other assets to choose from. I took a look at the site and saw page after page of assets including the following:

- Gold

- Silver

- Platinum

- Palladium

- Rhodium

- Copper

- Pre-made Portfolios

- Collectible coins, bars, rounds, jewelry, and more

In addition to the metals listed here, the company also has special offerings and sales.

Specials from Money Metals Exchange

Money Metals Exchange offers sales and you can find some great deals as you browse the site. Basically, when you look at the Specials page of the website, you can find deals and overstocked items at a discount. Special deals are updated regularly, and new sales are added all of the time. This makes it worth your time to check in every few days to see if there are any new items available.

News and Educational Resources

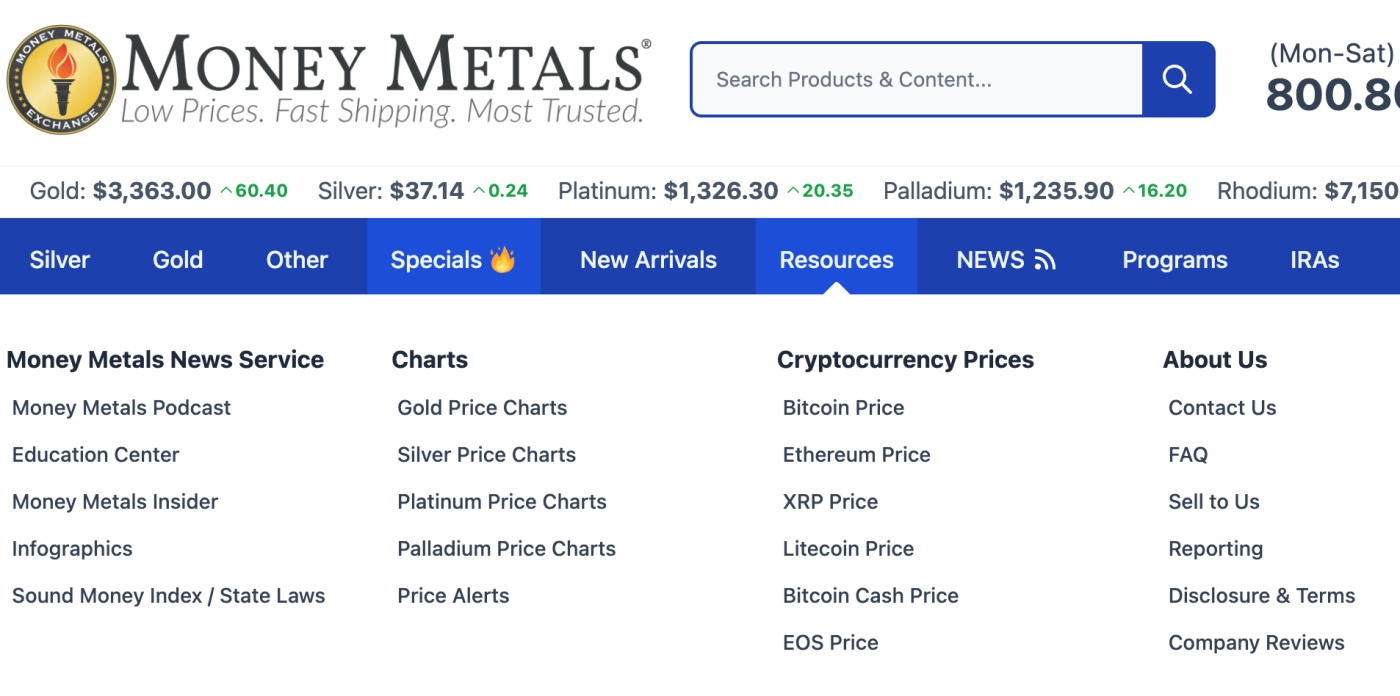

When browsing the website, you will also find a news/resource section. There, you can find price charts for precious metals as well as news and opportunities for education, which the company offers to both site visitors and clients. These resources include:

- Money Metals Podcast

- An education center

- Infographics

- Money Metals Insider

- Information about state laws and precious metals

All of these resources can be used by beginners to learn more about the precious metals industry, and it has a lot of great information for those who have experience, including the latest industry news.

Money Metals Exchange Depository

Unlike other companies, I quickly found that Money Metals Exchange has its own depository service. This is pretty unusual in the industry, and even after being in this industry for decades, I rarely see companies that offer this service. (When I invested I used the Texas Precious Metals Depository, for example.)

It’s so impressive because choosing a depository is typically challenging. This is especially the case when people are not sure about how safe or secure a depository is. Keep in mind that the company you choose will protect your metals until you retire, so it must be reliable. Money Metals Depository has some of the best approaches to security that I have seen, and they work hard to protect their clients’ assets with the highest quality storage.

The depository is located in Idaho, and the storage is segregated to keep customer’s assets separate, so no one makes a mistake and mixes up one person’s metals with another person’s.

Even the construction of the building is impressive. It’s made with thick steel and hardened concrete, which makes it almost impossible for anyone to get into the building. Within the building, itself, there are UL Class 3 vaults, which hold precious metals, too. That’s already a lot, and very impressive, but one more thing — the company uses Lloyd’s of London to ensure all of the metals their customers store is safe and secure.

Need to Liquidate? Money Metals Exchange Will Buy Your Metals

Something that first time investors don’t always realize is that it can be difficult to sell your metals when you need to liquidate them. It’s easy for precious metals investors to buy metals, but selling them is much more difficult. However, Money Metals Exchange will buy precious metals, and sellers can get great rates and get paid quickly.

The company offers a “Sell to Us” option right on the website. When you click that, you can read more about the buying process. This is a huge advantage because companies like ICCoin don’t offer this option.

The first step is to call the company and talk to one of their representatives. Once you explain why you are calling, they will talk to you about what the rates are and how the buying process works. The process was quite easy to understand and I thought the rates were really good. They gave me directions on how to ship the metals, and then I packed up what I had and shipped them to Money Metals Exchange right through the mail.

As soon as the team received the package, they did a quick analysis of the assets I sent, and then just according to plan, my payment was released.

Investing with Money Metals Exchange – The Full Process

A friend of mine sold my metals to them, and they found the process to be extremely easy. I want to mention that I looked into both buying precious metals and an IRA. I was very impressed by the guidance I received from the team. (Again, I didn’t go with them, I went with Goldco.)

I contacted them first to learn about the gold IRA investment options they have. The representative I spoke to was very helpful, and gave me a lot of information about what I could and could not add to my new gold IRA account.

On top of this, the representative explained the entire step-by-step process of investing. During the call, I definitely liked the sound of what they were telling me, and I thought the rep was very professional.

Step #1 – Open and Fund a New Precious Metals IRA

The first thing I did was talk to the company representative about the custodian. This is the company that works with you to get the new IRA funded. Money Metals Exchange primarily works with NDIRA, but they can work with other IRA custodians as well. Since I had a gold IRA account with another gold ira custodian already, I decided to keep this for research purposes and website content.

Step #2 – Fund the New Account

The custodian also helps to fund the account, and you can contact the custodian to get the process started. There are a few different ways to fund an account, and you can do it through a cash transfer or a rollover from an existing 401(k) or IRA.

Step #3 – Purchase Your Metals

After the account is funded, which takes a couple of days, you will let the custodian know that you are going to work with Money Metals Exchange as your dealer for the metals if you decide to move forward. You will then log onto the website and look at all the different options. Like other companies, you’ll be able to choose from a wide variety of assets.

Once you make your choices, the company helps to facilitate the transfer of your assets to their secure depository. You will be able to track your metals online throughout the process, and will be notified when they are safely stored.

Money Metals Exchange Costs and Fees

Money Metals Exchange offers competitive pricing on precious metals, and I definitely appreciated that. However, I was a bit shocked and surprised by the high transaction fees. Though the company offers a number of payment options, they charge extra fees for PayPal and crypto payments. The PayPal transaction fee was 4% and there was a 2% fee if you pay with cryptocurrency which seems crazy since this method of funding is the cheapest traditionally. There is no fee if you do a wire transfer, write a paper check, or use an e-check.

In addition to the fees above, there is also a storage fee assessed to your account. It is based on the value of your investment.

| Market Value of Asset | Fee |

|---|---|

| $0 – $15,999 | $96 |

| $16,000 – $99,000 | 0.59% (.0059) |

| $100,000 – $999,000 | 0.49% (.0049) |

| $1,000,000 – $2,999,999 | 0.39% (.0039) |

| Over $3,000,000 | Special |

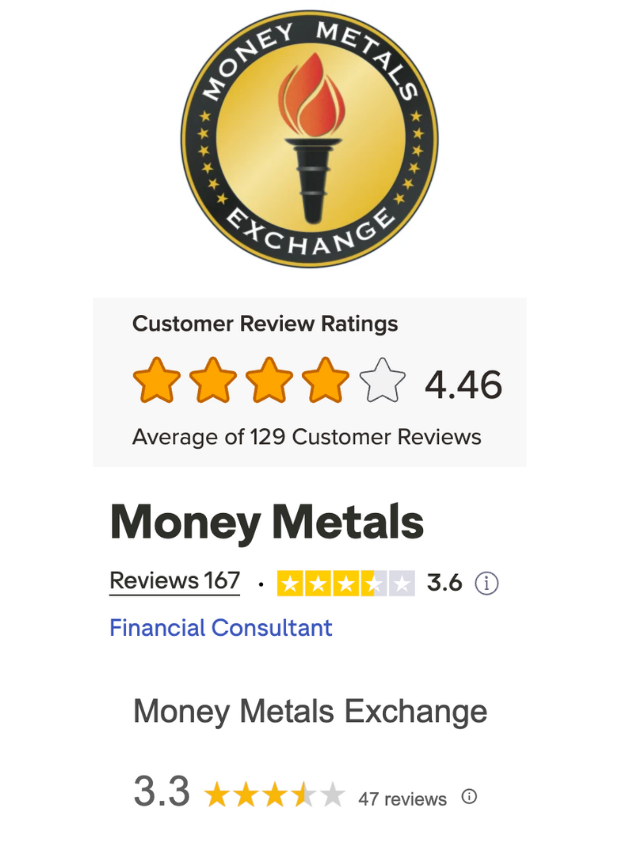

Money Metals Exchange Reviews

It’s important to look at reviews before settling on a company. Here are some of the most common consumer review site ratings:

Better Business Bureau

Money Metals Exchange has an A+ rating with the BBB, and it has been accredited since 2011. There are more than 100 reviews on the site, and the average rating is 4.46/5 stars.

TrustPilot

On TrustPilot, there are also more than 100 reviews. Currently, as of July 2025, Money Metals Exchange has a rating of 3.6/5 stars.

Users on Google have given Money Metals Exchange a 3.3/5 star rating. Currently, there are 47 reviews.

Pros and Cons of Money Metals Exchange

Pros

- The website features updated precious metals prices in real time

- Free shipping is available on orders over $199

- There is a price alert feature, which makes it easier to get the benefits of sudden price changes

- Pre-made portfolios are featured on the site for purchase, and they contain some of the most popular precious metals that investors are looking for.

- Educational resources and a newsletter helps you keep up to date on all of the news in the precious metals industry.

Cons

- The customer service team is only available by phone and email.

- There are fees that are tacked on to cryptocurrency, PayPal purchases, and credit card payments

Is Money Metals Exchange a Good Company?

When you look at Money Metals Exchange, you will find secure storage options, competitive prices, a lot of variety in regard to assets, special deals, a buyback service, and a top-notch customer service team. However, there are some considerations including high transaction fees and limited ways to contact customer support.

All companies have pros and cons, and if you choose Money Metals Exchange, you will need to keep this things in mind. I suggest comparing and contrasting companies when going through this process, and then you can find out more and make an informed decision about which company best fits your requirements.

About Tim Schmidt Sr.

Tim Schmidt is an Entrepreneur and Serial Investor. Since 2012 he’s been an advocate of alternative investments using a Self Directed IRA. His work has been featured in Yahoo! Finance, USA Today, Business Insider, and Tech Times, among others.